Breadcrumbs

Home / ESOP OverviewESOP Overview

Introducing the ESOP as an Ownership Succession Planning Strategy

Traditionally, there have been three options for owners to consider relative to their succession planning: sell to an Outsider, sell to an Insider or what we call a “till death do us part” strategy. Despite the availability of ESOPs as an ownership succession strategy for more than 35 years, few business owners are aware of this option and its many benefits.

Each of the four succession planning strategies mentioned above can be the best fit based upon a business owner’s situation and goals. I will introduce you to ESOPs as an Ownership Succession Strategy.

What is an ESOP?

There are three different parties or constituencies involved in ESOPs and the answer to this question depends upon which constituency’s perspective you consider.

- To an owner of a closely held company, an ESOP is a way to get money out of his company on a tax-advantaged basis and to transition control of his company to key employees or family (insiders).

- To the company’s employees, an ESOP is a retirement plan (like a 401k) that allows employees to share in the value of their company.

- To the Company, an ESOP is a vehicle of corporate finance that offers tax benefits not available anywhere else in the Internal Revenue Code.

How Does an ESOP Work?

An ESOP works in many respects like any other type of qualified retirement plan. But there are three distinct differences between an ESOP and every other type of qualified retirement plan. And it is these three differences that make an ESOP work as effectively as an ownership succession strategy.

- An ESOP can borrow money.

- It can engage in transactions with parties in interest. In this case, “parties in interest”

would be the owner or owners of the business. - An ESOP is required to invest primarily in the stock of the Company that sponsors the plan.

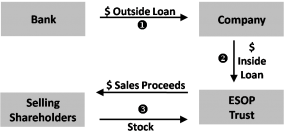

The following chart and step-by-step description illustrate how stock is sold to an ESOP in a typical Ownership Succession Planning scenario:

In Step 1, the Company obtains a loan, often from its current bank. This is referred to as the “Outside Loan.” Due to technicalities in the lending laws, banks almost never loan money directly to an ESOP. Instead, banks loan money to the company which then lends it to the ESOP.

In Step 2, the Company lends money to the ESOP. Generally, the Company loans the same amount it borrowed from the bank in Step 1, although the Company could lend the ESOP more or less. This is referred to as the “Inside Loan.” The terms (repayment period, interest rate, etc.) of the Inside Loan often mirror the terms of the Outside Loan but there may be reasons, in certain situations, for the terms of the Inside Loan to be different from the Outside Loan.

In Step 3, the ESOP Trust, or ESOT, uses the cash it received in the Inside Loan to purchase Company stock from the selling shareholder(s). The stock that is purchased will be held initially in the ESOTs “Suspense Account.”

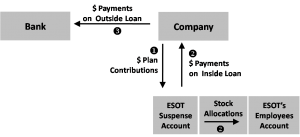

The following chart and the step-by-step description illustrate the annual activities involved in an ESOP.

What are the ESOP Tax Incentives?

Owners who sell stock to an ESOP will pay tax at the 15% long-term capital gains tax rate (worst case scenario). If the Company is a C corporation, the seller(s) may be able to defer tax, perhaps even permanently. Employees participating in the ESOPs are not taxed on the stock allocated to their accounts or on its earning until distributed generally at death, disability, retirement or termination of service (subject to vesting). Companies that sponsor ESOPs are able to deduct ESOP contributions (subject to certain limitations). This results in a Company converting what would have been a non-tax deductible principal payment on a loan into a tax deductible retirement plan contribution. This tax benefit is available for C and S corporations.

C Corporations also are able to deduct dividends paid on ESOP held stock under certain conditions. This is the only way a company can get a tax deduction for dividend payments and it may allow a company an avenue to get money into its ESOP in excess of the contribution limits referenced above.

S corporations are “flow-through” entities for tax purposes, which means that they do not pay tax. Instead, their income “flows through” to their owners who include their share of the company’s taxable income and on their tax return. Let’s follow a corporation through the process.

- Assume an S corporation has $5 million of taxable income and 2 equal shareholders; each of them would receive an IRS form K-1 for $2.5 million.

- Assuming that they pay tax at the 35% federal tax rate, each of them would pay $875,000 in federal income tax on the S corporation earnings.

- However, since an ESOT, like all qualified retirement plan trusts is tax exempt, its portion of the Company’s income is free from taxation.

- Therefore, in the example above, if an ESOP were one of the two owners, the tax liability on the Company’s income would be reduced in half, saving $875,000.

- If an ESOP owned all of the Company in this example, the Company’s $5 million of taxable income would be completely free from federal income tax, saving $1.75 million in income taxes.

As can be seen, Congress has created powerful tax incentives for business owners to use ESOP as an ownership succession planning vehicle and in so doing, share the wealth with their employees.